港湾公益︱双轨并行践公益初心 千万善款点亮教育希望与生命之光

2025年3月28日,深圳湾畔的东方港湾,一场跨越时空的教育传承与生命守护行动在此交汇。东方港湾董事长但斌先生以赤子之心回馈桑梓、以企业担当守护未来,于同一天启动了两笔重磅捐赠,以教育之火与医疗之光诠释“责任”的深刻内涵。

千万捐赠燃汴梁文脉,师生情谊续教育华章

当日,开封市人民政府副市长刘震携教育代表团专程赴深,向东方港湾董事长但斌先生赠送承载千年宋韵的汴绣《清明上河图》及“博学多识”书法作品。这场跨越1600公里的教育之约,点燃了开封二十五中校友但斌的炽热情怀——他宣布捐赠1000万元设立“东方港湾纪西奖校长奖励基金”。该基金以但斌先生的高中班主任张纪西命名,将重点奖励教育教学突出的教师与品学兼优学子,助力开封教育高质量发展。座谈会上,但斌动情回忆:“张老师曾说‘但斌是多棱镜,有缺点更有光芒’,这句评语照亮了我四十年人生路。”时值母校建校106周年,随着新校区落成、初中部启航,这份穿越时空的感恩之情更显珍贵。开封市教体局表示,此捐赠创下了当地基础教育单笔捐赠新纪录,将组建专项工作组确保基金规范运作。

五百万善款护鹏城幼苗,医疗公益铸生命防线

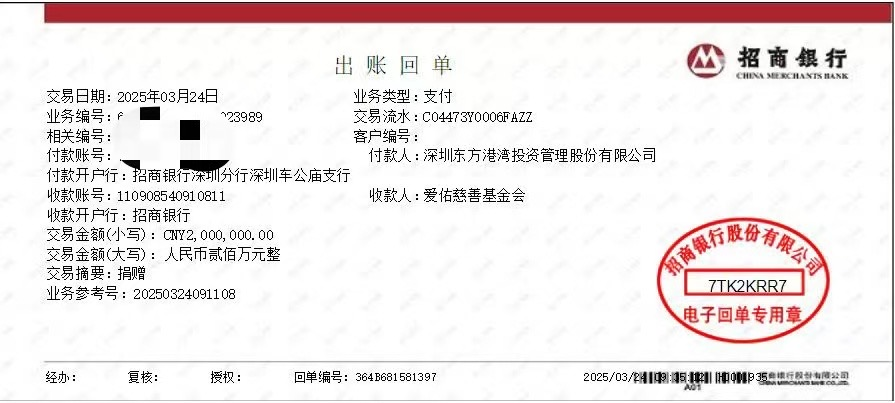

同日,东方港湾与爱佑慈善基金会签订500万元定向捐赠协议,首笔200万元善款已拨付。该捐赠将分三期支持深圳儿童医院,持续五年救助先天性心脏病等疾病的贫困家庭患儿。从黄河流域到南海之滨,企业以“本地化公益”践行对第二故乡深圳的深情回馈。但斌表示:“在深33年,我们愿以切实行动守护这座城市的未来。”

公益长跑显企业担当,多维践行筑责任基石

东方港湾自创立以来,始终将公益基因融入发展血脉:长期资助公益机构包括上海粉红天使癌症病友关爱中心、上海真爱梦想公益基金会(在提供资金资助的同时,为公益机构提供专门场地入驻办公)、四川海惠助贫服务中心、爱佑慈善基金会、上海杉树公益基金会等,见证着企业对社会痛点的持续关注;资助支持包括黄经耀将军故居、黄经耀将军生平事迹展、桐溪村道路基础设施、风雨亭、红军步道、河道改造等项目逐步完善,并成为开展青少年爱国主义教育的宝贵资源和重要平台,让历史记忆焕发新生;2020年捐资1699万元设立的“河南大学东方港湾高山创新奖基金”已连续3年评选并奖励在科学研究等方面表现突出的河大本科生;2021年继续向河南大学捐资1600万元,旨在进一步促进河大的校园建设,持续支持河大教育事业的发展……2025年初,更有东方港湾员工自发捐出当月工资助力癌症病友,将个人善举融入企业公益生态。

在未来,东方港湾还将继续投入更多公益资源,助力更多需要帮助的社会群体,正如汴绣金线在岁月中愈发璀璨,东方港湾作为以社会责任为底色的私募企业,正携手各界将点滴微光汇聚成照耀时代的星河。

Identification of qualified investors

I promise to buy private equity products for myself.

I promise to meet the average annual personal income of not less than 500,000 yuan in the last three years.

I promise to meet the financial assets of not less than 3 million yuan; (financial assets include bank deposits, stocks, bonds, fund shares, asset management plans, bank wealth management products, trust plans, insurance products, futures rights, etc.).

According to Article 14 of Chapter 4 of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds": Private equity fund managers and private equity fund sales institutions may not raise funds from organizations and individuals other than qualified investors, and may not use newspapers, radio, television , The Internet and other public media or lectures, lectures, analysis meetings and channels such as announcements, leaflets, mobile phone messages, WeChat, blogs and e-mails, and promote them to non-specific audiences.

Oriental Harbor strictly abides by the provisions of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds" and only promotes private equity investment fund products to specific qualified investors.

If you intend to invest in private equity funds and meet the requirements of the "Interim Measures for the Supervision and Administration of Private Equity Funds" regarding the "compliant investors" standard, you have the corresponding risk identification and risk-taking capabilities, and the amount invested in a single private equity fund is not It is less than 1 million yuan, and the personal financial assets are not less than 3 million yuan or the average annual personal income of the last three years is not less than 500,000 yuan. Please read this reminder in detail and register as a Oriental Harbor-specific compliant investor before you can receive Oriental Harbor private equity fund product promotion services.

User login

Identification of qualified investors

I promise to buy private equity products for myself.

I promise to meet the average annual personal income of not less than 500,000 yuan in the last three years.

I promise to meet the financial assets of not less than 3 million yuan; (financial assets include bank deposits, stocks, bonds, fund shares, asset management plans, bank wealth management products, trust plans, insurance products, futures rights, etc.).

According to Article 14 of Chapter 4 of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds": Private equity fund managers and private equity fund sales institutions may not raise funds from organizations and individuals other than qualified investors, and may not use newspapers, radio, television , The Internet and other public media or lectures, lectures, analysis meetings and channels such as announcements, leaflets, mobile phone messages, WeChat, blogs and e-mails, and promote them to non-specific audiences.

Oriental Harbor strictly abides by the provisions of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds" and only promotes private equity investment fund products to specific qualified investors.

If you intend to invest in private equity funds and meet the requirements of the "Interim Measures for the Supervision and Administration of Private Equity Funds" regarding the "compliant investors" standard, you have the corresponding risk identification and risk-taking capabilities, and the amount invested in a single private equity fund is not It is less than 1 million yuan, and the personal financial assets are not less than 3 million yuan or the average annual personal income of the last three years is not less than 500,000 yuan. Please read this reminder in detail and register as a Oriental Harbor-specific compliant investor before you can receive Oriental Harbor private equity fund product promotion services.

Identification of qualified investors

I promise to buy private equity products for myself.

I promise to meet the average annual personal income of not less than 500,000 yuan in the last three years.

I promise to meet the financial assets of not less than 3 million yuan; (financial assets include bank deposits, stocks, bonds, fund shares, asset management plans, bank wealth management products, trust plans, insurance products, futures rights, etc.).

According to Article 14 of Chapter 4 of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds": Private equity fund managers and private equity fund sales institutions may not raise funds from organizations and individuals other than qualified investors, and may not use newspapers, radio, television , The Internet and other public media or lectures, lectures, analysis meetings and channels such as announcements, leaflets, mobile phone messages, WeChat, blogs and e-mails, and promote them to non-specific audiences.

Oriental Harbor strictly abides by the provisions of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds" and only promotes private equity investment fund products to specific qualified investors.

If you intend to invest in private equity funds and meet the requirements of the "Interim Measures for the Supervision and Administration of Private Equity Funds" regarding the "compliant investors" standard, you have the corresponding risk identification and risk-taking capabilities, and the amount invested in a single private equity fund is not It is less than 1 million yuan, and the personal financial assets are not less than 3 million yuan or the average annual personal income of the last three years is not less than 500,000 yuan. Please read this reminder in detail and register as a Oriental Harbor-specific compliant investor before you can receive Oriental Harbor private equity fund product promotion services.

Set new password

尊敬的投资者:

为切实保障您的投资权益,应中基协《私募投资基金募集行为管理办法》要求,投资者了解私募基金信息前应提供真实身份信息并参与风险问卷评测,敬请协助我们完成信息补充和评测认证,一次通过后3年内无须再次评测,谢谢您的支持。

Oriental Harbor (Hong Kong) Investment Management Co., Ltd

请选择您的用户类型参加问卷评测

风险承受能力问卷(个人版)

(一次评测完成后3年内无须再次评测。若个人/机构发生重大改变,可在用户中心主动申请再评测)

私募基金投资需要承担各类风险,本金可能遭受损失。同时,投资时还应考虑市场风险、管理风险、流动性风险、操作风险等各类风险。您应在基金认购过程中注意核对自己的风险识别和风险承受能力,选择与自己风险识别能力和风险承受能力相匹配的私募基金。以下问题可协助评估您的风险承受能力,请在选项前打○)

-

1、您的年龄在以下哪个范围内?

风险承受能力问卷(个人版)

(一次评测完成后3年内无须再次评测。若个人/机构发生重大改变,可在用户中心主动申请再评测)

免责声明:测试结果来自投资者所提供的资料,不可视为对任何投资产品及服务的销售或购买邀请,亦不应当为投资建议,只供投资者作投资决定时参考。本公司对相关信息的准确性及完整性不负任何责任。

6666

Evaluation results

I promise to buy private equity products for myself.

I promise to meet the average annual personal income of not less than 500,000 yuan in the last three years.

I promise to meet the financial assets of not less than 3 million yuan; (financial assets include bank deposits, stocks, bonds, fund shares, asset management plans, bank wealth management products, trust plans, insurance products, futures rights, etc.).

According to Article 14 of Chapter 4 of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds": Private equity fund managers and private equity fund sales institutions may not raise funds from organizations and individuals other than qualified investors, and may not use newspapers, radio, television , The Internet and other public media or lectures, lectures, analysis meetings and channels such as announcements, leaflets, mobile phone messages, WeChat, blogs and e-mails, and promote them to non-specific audiences.

Oriental Harbor strictly abides by the provisions of the "Interim Measures for the Supervision and Management of Private Equity Investment Funds" and only promotes private equity investment fund products to specific qualified investors.

If you intend to invest in private equity funds and meet the requirements of the "Interim Measures for the Supervision and Administration of Private Equity Funds" regarding the "compliant investors" standard, you have the corresponding risk identification and risk-taking capabilities, and the amount invested in a single private equity fund is not It is less than 1 million yuan, and the personal financial assets are not less than 3 million yuan or the average annual personal income of the last three years is not less than 500,000 yuan. Please read this reminder in detail and register as a Oriental Harbor-specific compliant investor before you can receive Oriental Harbor private equity fund product promotion services.